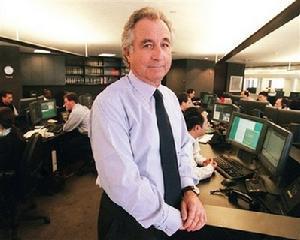

伯纳德・马多夫是美国纳斯达克市场前主席。2008年12月11日上午8点,伯纳德・马多夫因涉嫌进行一项规模达500亿美元的“庞氏骗局”而被美国联邦调查局逮捕并被起诉接受调查。如果罪行确凿,他将面临20年的牢狱之灾和最高达500万美元的罚金。美国媒体报道称,这可能是美国历史上最大的诈骗案之一。美国证券和交易委员会要求冻结资产的公司,并任命一名接收人员,欺诈被指控高达500亿美元。

马多夫_伯纳德・马多夫 -概述

马多夫是如何卖拐

伯纳德・马多夫曾担任过纳斯达克证交所的主席,仍是纳斯达克OMX集团提名委员会的一名成员。1960年,伯纳德・马多夫从法学院毕业,用做海滩救生员赚来的5000美元创建伯纳德・马多夫投资证券公司,并因此闻名华尔街。这家公司主要以担任股票买卖的中间人而闻名。马多夫还领导着一项投资顾问业务,这一业务专为富人、对冲基金和其他机构投资者理财。2001年,马多夫公司被称为纳斯达克股票市场的三大提供上市咨询的经纪公司之一,纽交所第三大经纪公司。马多夫的投资证券中介公司,曾为350只纳斯达克股份提供服务,包括苹果、eBay和戴尔计算机等。

马多夫_伯纳德・马多夫 -个人介绍

伯纳德・马多夫

姓名:伯纳德・马多夫

又名:伯纳德・麦道夫

英文名:Bernard L.Madoff

出生年月:1938年

职务:投资证券公司创始人

美国纳斯达克证券交易所董事局主席

马多夫_伯纳德・马多夫 -中英文对照简介

・简介

Madoff was born in New York to a Jewish family.He is married to Ruth Madoff and has two sons, Mark and Andrew.Madoff has several homes in New York State. Two of them are on Long Island in Roslyn and Montauk respectively and the third one, his primary residence on Manhattan's Upper East Side, is valued at more than $5 million. He also owns homes in Palm Beach, Florida and in France.

Madoff出生在纽约一个犹太人family.He已婚,露丝Madoff和有两个儿子,马克和若干Andrew.Madoff家园已在纽约州。其中两个是在长岛的罗斯林和蒙托克分别和第三个,他的主要居住在曼哈顿上东城,是价值超过500万美元。他还拥有房屋棕榈滩,佛罗里达州和法国。

Bernard Lawrence Madoff (born April 29, 1938) is a former American fund manager and business owner who started the Wall Street firm Bernard L. Madoff Investment Securities LLC. He was chairman of that firm, which he founded in 1960, until December 11, 2008, when he was arrested and charged with securities fraud.

贝尔纳劳伦斯Madoff (生于1938年4月29日)是前美国基金经理人与企业所有者谁开始的华尔街公司伯纳德研究Madoff投资证券有限责任公司。他曾担任该公司,他于1960年成立,直到08年12月11日,当他被捕并被控证券欺诈。

Bernard L. Madoff Investment Securities, which is in the process of being liquidated, was one of the top market maker businesses on Wall Street and also encompassed an investment management and advisory division, which is now the focus of the fraud investigation.

贝尔纳研究Madoff投资证券,这是的过程中,被清算,是一个顶端做市商企业在华尔街,也包括投资管理和咨询师,这是现在的重点欺诈调查。

On December 11, 2008, Federal Bureau of Investigation arrested Madoff on a tip from his sons, Andrew and Mark, and charged him with securities fraud. On the day prior to his arrest, Madoff told his senior executives that the management and advisory segment of the business was "basically, a giant Ponzi scheme."Five days after his arrest, Madoff's assets and those of his firm were frozen and a receiver was appointed to handle the case.Madoff's fraud is alleged to involve up to $50 billion in cash and securities and to have taken place over a period of decades.To date, it is the largest investor fraud ever attributed to a single individual.Banks from Spain, France, Switzerland, Italy, Holland and other countries have announced that they have potentially lost billions in U.S. dollars from the Madoff scandal.

12月11日, 2008年,联邦调查局逮捕Madoff的冰山从他的两个儿子,安德鲁和马克,并指控他与证券欺诈行为。关于前一天逮捕他, Madoff告诉他的高级管理人员的管理和咨询部门的业务是“基本上,一个巨大的庞兹骗局。 ”五天后,他被逮捕, Madoff的资产和他的公司被冻结和一个接收器被任命为处理case.Madoff的欺诈指控涉及高达500亿美元的现金和证券,并发生了一段decades.To迄今为止,这是最大的投资者欺诈以往任何时候都归因于一个单一的从individual.Banks西班牙,法国,瑞士,意大利,荷兰和其他国家都宣布,他们有可能损失数十亿美元从Madoff丑闻。

Before his arrest, Madoff was a prominent businessman and philanthropist.As a result, the freeze of his and his firm's assets significantly affected businesses around the world, as well as a number of charities,one of which

爱华网

爱华网