http://www.jiazhizaixian.com/bbs/read.php?tid=52

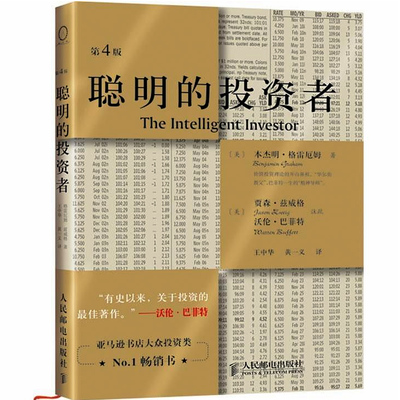

格雷厄姆 聪明的投资者

Preface to the Fourth Edition,第四版序言

by Warren E. Buffett

沃伦*巴菲特

I read the first edition of this book early in 1950, when I wasnineteen. I thought then that it was by far the best book aboutinvesting ever written. I still think it is.

早在1950年,我19岁的时候就读到了这本书的第一版。那时我想:这是迄今为止出版的最棒的一本关于投资的书籍。现在,我还这么认为。

To invest successfully over a lifetime does notrequire a stratospheric[ii] IQ, unusual business insights, orinside information. What’s needed is a sound intellectual frameworkfor making decisions and the ability to keep emotions fromcorroding that framework. This book precisely and clearlyprescribes the proper framework. You must supply the emotionaldiscipline.

想要在一生的时间获得投资成功,并不需要超群的智商、非凡的商业远见或者内幕消息,需要的是一个能够帮助自己做出决定的比较完善的知识框架,和一种排除情绪干扰的能力。这本书准确而又清晰地介绍了这样的知识框架。不过,你得自己“补上”控制情绪的戒律。

If you follow the behavioral and businessprinciples that Graham advocates—and if you pay special attentionto the invaluable advice in Chapters 8 and 20—you will not get apoor result from your investments. (That represents more of anaccomplishment than you might think.) Whether you achieveoutstanding results will depend on the effort and intellect youapply to your investments, as well as on the amplitudes ofstock-market folly that prevail during your investing career. Thesillier the market’s behavior, the greater the opportunity for thebusiness-like investor. Follow Graham and you will profit fromfolly rather than participate in it.

如果你遵从格雷厄姆宣讲的行为准则和商业原理,特别是你留意书中第八章和第二十章的非凡的建议,你就不会得到一个差强人意的投资结果。(这些原理所产生的成就可能远超你所想。<3>)你能否取得出色的投资成果,那要看你在投资上的理解力和努力程度,也要看你的投资生涯中,股票市场的荒谬和热闹的程度。市场越疯狂,严肃的(像做生意一样的)投资者的机会越大。遵循格雷厄姆的投资原则,你会从荒唐的喧嚣中获益,而不是被诱惑而参乎其中。

To me, Ben Graham was far more than an author or a teacher. Morethan any other man except my father, he influenced my life. Shortlyafter Ben’s death in 1976, I wrote the following short remembranceabout him in the Financial Analysts Journal. As you read the book,I believe you’ll perceive some of the qualities I mentioned in thistribute.

对我而言,本*格雷厄姆不仅仅是一个作者或者老师,他是除我父亲之外,影响我一生的人。在本1976年去世后不久,我在《财务分析师》杂志写了一篇关于他的回忆文章。当你阅读本书的时候,我相信你会认同我在这篇颂词中提到的一些品质。

爱华网

爱华网