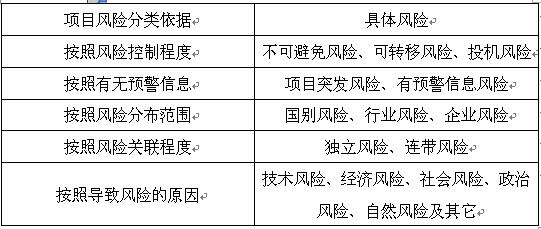

小编为大家介绍了风险的分类,希望对你有帮助哦!

We now turn our attention to the classes into which risk can be placed. This is different from scrutinizing the actual idea of risk, we are now looking at the whole concept of risk and grouping together similar classes of risk. Of the many classes, we will look at three.

Financial and non-financial risks

A financial risk is one where the outcome can be measure() in monetary terms. This is easy to see in the case of material damage to property, theft of property or lost business profit following a fire. In cases of personal injury, it can also be possible to measure financial loss in terms of a court award of damages, or as a result of negotiation between lawyers and insurers. In any of these cases, the outcome of the risky situation can be measured financially.

There are other situations where this kind of measurement is not possible. Take the case of the choice of a new car, or the selection of an item from a restaurant menu. These could be construed as risky situations, not because the outcome will cause financial loss, but because the outcome could be uncomfortable or disliked in some other way. There may or may not be financial implications but in the main the outcome is not measurable financially but by other, more human, criteria.

Pure and speculative risks

Pure risks involve a loss or, at best, a break-even situation. The outcome can only be unfavourable to us, or leave us in the same position as we enjoyed before the event occurred. The risk of a motor accident, fire at a factory, theft of goods from a store, or injury at work are all pure risks with no element of gain:

The alternative to this is speculative risk, where there is the chance of gain. Investing money in share is a good example. The investment may result in a loss or possibly a break-even position, but the reason it was made was the prospect of gain.

Fundamental and particular risks

Fundamental risks are those which arise from causes outside tile control of any one individual or even a group of individuals. In addition, the effect of fundamental risks is felt by large numbers of people. This classification would include earthquakes, floods, famine, volcanoes and other natural "disasters". However it would not be accurate to limit fundamental risk to naturally occurring perils. Social change, political intervention and war are all capable of being interpreted as fundamental risks.

In contrast to this form of risk, which is impersonal in origin and widespread in effect, we have particular risks. Particular risks are much more personal both in their cause and effect. This would include many of the risks we have already mentioned such as fire, theft, work related injury and motor accidents. All of these risks arise from individual causes and 'affect individuals in their consequences.

我们现在来看风险可以分成哪些类别。这跟审查风险的真实含义不同,我们现在看到的是风险的整体概念并且是把相似的风险汇集起来。在这许多种类中,我们将看到三类。

财务风险和非财务风险

财务风险是指后果可以用金钱来估量的风险。如果财产遭到实质上的损坏或是遭到偷窃,或是火灾后商业利益遭到损失,那是很容易看到的。如果个人受伤,也可能用金钱来估量法定的受伤赔偿,或者由律师和保险人进行协商得出一个赔偿金额。无论是哪种情况,风险的后果都可以用金钱来估量。

还有其他一些情况是不可能进行这种估量的。比如选择一辆新车,或者从餐馆菜单中点菜。这些可以被认为是有风险的情况,不是因为其后果会导致经济损失,而是因为其后果可能在其他方面让人觉得不舒服或者是不喜欢。这可能会牵涉到声钱,也可能不会,但总的来说,后果不是用金钱而是用其他更具人情味的标准来估量的。

纯粹风险和投机风险

纯粹风险包括损失或者充其量是收支相抵的情况。其后果只能对我们不利,或者让我们处于跟事件发生前一样的情况下。车祸、工厂的火灾、商场货物的偷窃、或者是工伤,这些风险都是不能获利的纯粹风险。

与之相对的是投机风险,这种风险是有可能获利的。股票投资就是一个很好的例子。这种投资可能有损失或者可能收支相抵,但是投资的目的是为了获利。

基本风险和特定风险

基本风险是指那些由超出个人甚至是群体的原因引起的风险。而且很多人都能感受到基本风险的影响。这类风险包括地震、水灾、饥荒、火山及其他自然灾难。然而,把基本风险局限于自然危险是不准确的。社会变革,政治干涉和战争都可以被认为是基本风险。

与这种非人为而有广泛影响的风险相对的,我们说是特定风险。特定风险在起因和影响两方面都更加与人相关。它包括我们已经提到过的很多风险,例如火灾、偷窃、工伤以及车祸。所以这些风险由个人引起并且最终影响到个人。

爱华网

爱华网