近年来,中国经济保持快速发展,为世界经济发展注入了活力。下面是小编给大家整理的中国经济发展的英文作文,供大家参阅!

中国经济发展的英文作文篇1

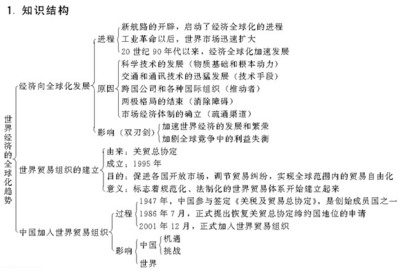

近年来,中国经济保持快速发展,为世界经济发展注入了活力。实践证明了中国在加入世贸组织之前的预言:中国的发展离不开世界,世界的发展需要中国。未来20年,在全面建设小康社会的进程中,中国一定会对世界经济的发展和实现全人类的共同进步做出历史性的贡献。为此,中国将继续扩大外贸,大力实施西部大开发战略,进一步改善投资环境,为外商提供更大的商机。同时,中国将引导和支持更多有比较优势的企业对外投资,开展平等互利形式多样的经济技术合作。中国将进一步加强双边、多边和区域经济合作,实现世界各国各地区的共同发展。

In recent years, China’s economy has maintained rapid development, injecting vigor into global economic growth. Facts have confirmed the prediction made by China before its WTO accession: China’s development cannot be sustained without the world, and world development needs China. In the coming 20 years, China is bound to make historic contributions to global economic development and to the common progress of mankind, while building a well-off society in an all-round way. To achieve this, China will continue to expand foreign trade, energetically implement its west development strategy, further improve its investment environment, and provide overseas investors with greater business opportunities. Meanwhile, it will guide and support competitive enterprises to invest overseas and carry out diverse forms of economic and technological cooperation on the basis of equality and mutual benefit. China will further intensify bilateral, multilateral and regional economic cooperation, so as to achieve common development in all countries and regions in the world.

中国经济发展的英文作文篇2

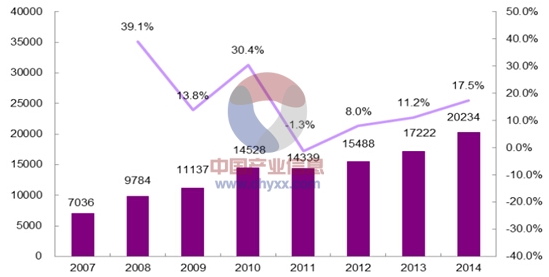

For the last thirty years, China's economy averaged a growth rate of close to 10% a year. Now, with China on the cusp of a crucial leadership transition - and of joining the club of advanced economies that has fallen away. The latest numbers shows growth in the third quarter at just 7.4%.

Is 7% 8% growth the new normal? Or is a further sharp slowdown in China's economy inevitable? China Real Time has asked two of the leading experts on the world's second-largest economy to debate that question:

Nick Lardy, an expert on China's economy at the Peterson Institute, is arguing current growth rates can be sustained. Michael Pettis, a

professor of finance at Peking University, is arguing a further sharp slowdown is inevitable. The opening exchange of views is posted below, with more to be posted next week.

中国经济发展的英文作文篇3

Dear Michael,

China's economic growth has now slowed for seven consecutive quarters and the bears are arguing not only is real growth lower than the headline number but that a further sharp slowdown in China's economy is inevitable.

Certainly a quick recovery from the 7.7% pace of growth in the first three quarters of this year to the double-digit growth rates of the recent past is not on the cards. Indeed it is more likely that we will see growth over the next two to three years in the 6.5% 8% range, with some possibility for slightly higher growth beyond that time horizon, if the new leaders can introduce the right reforms.

The main causes of the slowdown are the weak external sector, with the shrinkage of net exports subtracting almost a half a percentage

point of economic growth in the first three quarters this year, and softening investment, particularly for property. But with China's broad external surplus at a 10-year low in the first half of this year, absent a complete European melt down (in which case all bets are off), the drag on growth from the external sector is not likely to worsen significantly from here. The bigger worry is property investment, which is growing at barely half the pace of 2011 but still twice as fast as the underlying economy. If property investment moderates further for several additional quarters, GDP growth could slide to under 7%.

On a more bullish note, consumption demand played a more positive role in generating economic growth last year as both private and government consumption as a share of GDP notched up their biggest increases in more than a decade. The growth of average disposable income of urban residents relative to GDP growth in the first three quarters is even more favorable this year than last, providing the foundation for relatively strong private consumption growth again this year, helping to cushion any further slowdown in property investment.

If the government strengthens its policies to rebalance the sources of

economic growth by continuing to allow the value of the renminbi to be mostly market determined, further liberalizing deposit interest rates, and eliminating unwarranted subsidies for industrial energy consumption, the sources of China's economic growth could be gradually rebalanced away from investment in favor of private consumption expenditure, thus putting China's growth on a more sustainable path.

Adopting this policy package is a not an unlikely outcome of the upcoming leadership transition. It is one thing for the Hu Jintao Wen Jiabao leadership to go out of office on a weak economic note - after all they achieved the highest average 10 year economic growth in recorded Chinese history.

It is quite another for the Xi Jinping-Li Keqiang leadership coming into office to contemplate a further deterioration of China's economic performance in their first years. The intellectual case for an accelerated pace of economic reform has been well established in China. If Xi and Li can overcome the entrenched vested interests that have slowed reform to a crawl in recent years they will be laying the foundation for stronger economic growth over the medium term, say something in the 7.5% 8.5% range beginning in

about three years.

Best regards,

Nick

中国经济发展的英文作文篇4

Dear Nick,

There are at least two reasons for predicting that China's economic growth will slow substantially in the next few years. The first has to do with historical precedents and the second with the logic of China's rebalancing.

The historical precedents are clear. Many countries in the past one hundred years have gone through periods of extraordinary growth, powered by very high and rising levels of investment. In every case these countries developed serious imbalances, either internally, if the investment was financed by consumption-constraining policies, or externally, if they were not.

In the early stages, it was always relatively easy to find economically viable investments, but as institutional constraints required the persistence of high levels of investment, and as it became increasingly difficult to ensure that investment was economically viable, in later stages investment was always misallocated and debt grew faster than debt servicing capacity.

This combination of extreme imbalances and high levels of debt, driven by misallocated investment, resulted in a subsequent period of rebalancing that turned out to be far more difficult than even the skeptics had predicted. China's development model has differed from its predecessors only in that the imbalances have exceeded any that we have seen in prior history, and the amount of misallocated investment may have also exceeded all precedents.

For this reason it would be surprising, and an historical anomaly, if China's rebalancing were not a very difficult one. Not only has China pushed the imbalances associated with the investment growth model to extremes that exceed any seen before, but it is becoming increasingly clear that the obstruction to any meaningful adjustment by sectors that have benefitted most from domestic economic distortions will make the adjustment politically very difficult.

This historical argument is buttressed by the arithmetic of rebalancing. It is widely recognized that investment growth must be curtailed sharply, but it isn't at all clear what will replace it as China's growth engine. Given the deep problems in the global economy it is hard to imagine a sharp increase in exports. This leaves us only with consumption, but here the prospects have been very disappointing.

Beijing has managed to boost government consumption recently, but since government expenditures are financed mainly by hidden transfers from the household sector - especially in the form of repressed borrowing costs - any increase in government expenditures today will only mean downward pressure on household income, and with it household consumption, in the future. It is household consumption growth, in other words, that creates the only sustainable source of future growth.

The growth in Chinese household consumption has been quite strong in the past decade. Household consumption has grown by roughly 7% annually, which is faster than in any other large economy in the world. But this rapid growth was attained only because global

conditions were optimal and Chinese investment growth was so extraordinarily high that it was able to turbo-charge GDP growth at rates of 10% 11% for much of the past decade.

Global and Chinese conditions are not nearly as good anymore. This means that it will be hard to maintain 7% household consumption growth even in the best-case scenario. But rebalancing in China means by definition that household consumption growth has to outpace GDP growth by at least 3 or 4 percentage points every year for the next decade just to bring Chinese consumptions levels to rates equivalent to the lowest consuming countries in the world.

This is just another way of saying that the growth contribution of investment has to drop so sharply that GDP growth cannot exceed 3% 4% if China is to rebalance. Any higher GDP growth cannot be consistent with even a minimal rebalancing of the Chinese economy unless there is some way to force much greater growth in household consumption i.e. much greater growth in household income in spite of much worse global and Chinese economic conditions.

The arithmetic simply doesn't work. China must rebalance its

economy because its over-reliance on investment has become toxic. For China even to maintain GDP growth rates of even 7% to 8% implicitly requires that household consumption grow by 10% 12%, something never before achieved even under much better economic conditions. Without a deus ex machine that turbocharges consumption growth, high GDP growth rates are incompatible with rebalancing.

Best regards,

Michael

爱华网

爱华网